LESSON 4: LIFE INSURANCE PREMIUMS, PROCEEDS AND BENEFICIARIES

The following subjects are contained within Lesson 4:

Primary Factors in Premium Calculations - Mortality Factor, Interest Factor, Level Premium Funding, Policy Reserves; Cash Values; Other Premium Factors (Age, Gender, Health, Occupation, Habits); Methods of Rating Substandard Risks (Extra Percentage Tables, Permanent Flat Extra Premiums, Temporary Flat Extra Premiums, Rating-Up In Age, Lien System)

Policy Proceeds and Settlement Options - Single Premium Payment (Lump Sum) Method; Interest Only Payments; Installment Payments (Fixed Period Option, Fixed Amount Option, Income For Life, Joint Life Income, Special Payment Plans); Accelerated Benefits; Viatical Settlements

Tax Treatment of Proceeds - Cash Values; Proceeds Paid at Death, 1035 Contract Exchanges

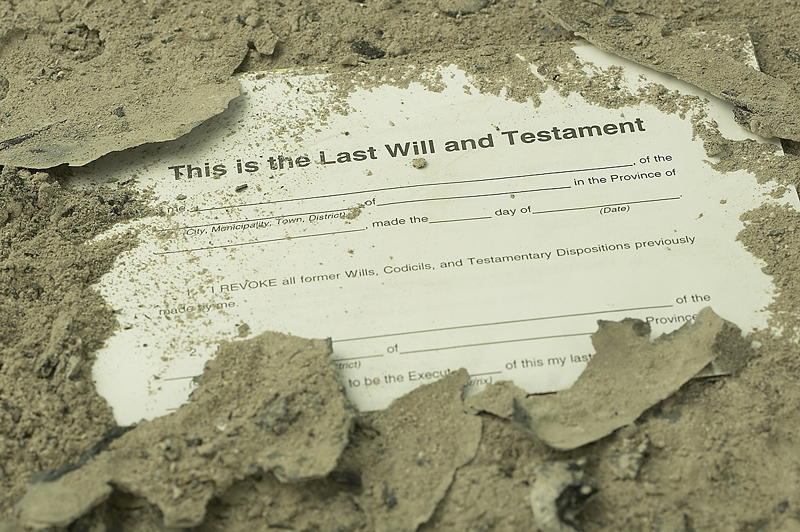

Beneficiaries - Types of Designations (Primary, Secondary, Tertiary); Naming an Entity as Beneficiary (Trusts, Estates, Charities); Naming Individuals as Beneficiaries (Per Capita Method, Per Stirpes Method, Minors, Special Class Designations); Changing Beneficiaries (Revocable, Irrevocable, Absolute, Reversionary); Special Situations (Uniform Simultaneous Death Act, Common Disaster Provision); Spendthrift Trust Clause; Facility-of-Payment Provision

Lesson Review - Key Concepts; Quiz

The information contained in Lesson 4 can be found in

Units 7 and 8 of the Florida study manual.