4.1.3 Level Premium Funding

As we've already learned, the age of the insured directly affects the cost of premiums. With term insurance, the premium cost is adjusted at the end of the policy's term according to the advancing age of the insured. With whole life insurance, premium cost is based on level premiums, cash value and maturity at age 100.

Because the premiums of whole life policies are not increased and remain level, the cost is higher than term in the beginning allowing for the accumulation of excess funds (referred to also as cash value). Actuaries calculate the cost of the premiums required on a continuous basis until maturity by using an assumed interest rate, assumed mortality charge, and assumed loading charge.

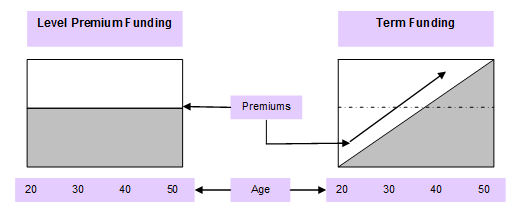

As demonstrated by the diagram below, you can see how the term premium is lower than the level premium funding method in the beginning. About halfway through the policy period, the term premium catches up with the level premium and eventually surpasses it.