7.7.1 Accumulation Units and Annuity Units

What are the structural components of a variable annuity?

The values in a variable annuity are expressed in terms of units rather than dollars. There are two types of units: Accumulation units and annuity units. The value of each type of unit is subject to periodic adjustments based upon the performance of the underlying common stock portfolio.

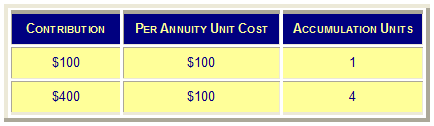

Prior to retirement, the purchaser of a variable annuity pays an agreed-upon periodic premium amount. When these periodic premiums are paid, the purchaser is credited with a number of accumulation units. The actual number of units is determined by the current value of one unit relative to the amount of premiums paid.

How is the value of an accumulation unit determined?

The value of an accumulation unit typically is a function of the after-tax interest earned, dividends received and capital gains (or losses) incurred, less investment expenses associated with the insurer equity investment portfolio supporting the annuity. This is similar to the valuation of the unit values determined for shares in a mutual fund.

At the time of retirement, the annuity unit calculation is made and, from then on, the number of annuity units remains the same for that annuitant. The value of one annuity unit is dependent upon the results of investments made; the annuitant may receive varied amounts at times.

During the variable annuity's accumulation period, periodic premium deposits, referred to as dollar cost averaging, are made. The accumulated shares are converted into accumulation units (statistical symbols) and credited to the individual's account.

Are the investment gains (losses) reflected in the accumulation unit values subject to current income taxation?

No. As in fixed annuities, the investment experience on funds invested in a deferred annuity is not currently taxable to the purchaser.

At the time of annuity payout, the units are then converted into annuity units. The annuitant receives an identical number of units at each distribution period. When the time comes to send out the payment, the annuity company sells the stipulated number of shares of the underlying fund. The market value of the shares then determines the amount of the distribution check.

Insurers are required by law to provide annuity owners with an annual report (on a pre-approved form) which states the units credited to the contract and the dollar value of a unit. The data must be updated no more than two months prior to the date the report is mailed.