10.3.2.1 Partnership Cross-Purchase Buy-Sell Plans

Businesses that are in partnership follow the same basic principles but in a different way. According to law if one partner dies, the partnership is automatically terminated. Naturally, the partners want to protect themselves and each other in case one of them dies. A buy-sell agreement can allow the partnership to survive even if one partner is no longer there. Each partner takes out a life insurance policy on the other partners.

With a partnership cross-purchase buy-sell plan, the surviving partners agree to purchase the deceased's portion of the business at a predetermined price and the deceased's heirs must sell the business to them at that price. Each partner takes out a life policy on the others equal to one-half of the partner's share.

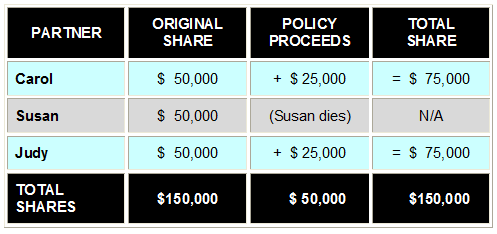

Carol, Susan, and Judy are equal partners in their own catering business valued at $150,000. Each owner's share of the business is equal to $50,000.

Carol, Susan, and Judy are equal partners in their own catering business valued at $150,000. Each owner's share of the business is equal to $50,000.

Carol takes out a $25,000 life policy on Judy and a $25,000 life policy on Susan, and Judy takes out a $25,000 life policy on Carol and a $25,000 life policy on Susan, and Susan takes out a $25,000 life policy on Judy and a $25,000 policy on Carol.