10.4.1 Salary Continuation Plans

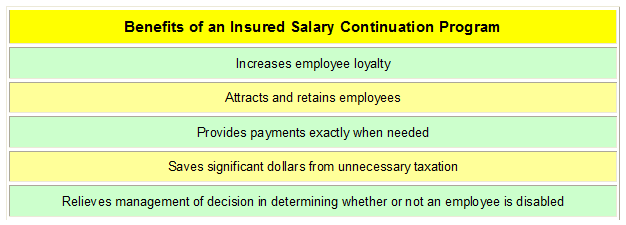

Salary continuation plans are nonqualified plans specifically designed with a wide degree of flexibility. A salary continuation plan allows corporate officers' discretion regarding who can be promised benefits and how large the benefits can be.

A salary continuation plan is set up between the employer and employees and is funded by the employer.

The benefits provided under the plan will determine the cost of the plan. Benefits are usually predicated on a certain percentage of the insured's salary and length of employment. In return, the employee promises to stay with the employer until retirement. There may also be a noncompete agreement thrown into the terms of the agreement.

Typically, an employer will fund a salary continuation plan by purchasing a life insurance policy on the employee. The accumulated cash value of the life policy can be used to pay the benefit when it becomes due. If the employer must pay the benefit out of available cash, the company is reimbursed upon the insured's death because the company is the beneficiary and therefore collects the death benefit. Since the employer is both the owner and beneficiary of the policy, the employer does not receive a tax deduction on the premiums paid. If the employer surrenders the policy, the difference between the cash received and the premiums paid is taxed as ordinary income.

"Raise Time"

"Raise Time"

XYZ Company knows that it's "raise time" but doesn't want to increase payroll right now. Instead of increasing salaries at this time, they decide to offer their executives a plan that will pay their salary for a certain period of time (5, 10, 15 years) after they retire. Several of the employees realize that they didn't plan for retirement as well as they should have and they opt to take advantage of the Salary Continuation plan in lieu of a salary increase.

Plans can also be tailored to cover the employee if he/she becomes disabled prior to retirement.