11.4.2 Business Needs

Businesses are comprised of individuals; and business needs are just as important. Just as HMOs stress preventive health care, health insurance allows businesses to continue basically uninterrupted because its employees are taken care of healthwise. For some, the deciding difference between accepting a job offer or moving on is when the prospective employer adds medical coverage to the benefit package.

The employer gains as well through tax deductions, employee loyalty, gaining an edge in the employment market, and increasing the company's reputation and image.

Cafeteria Plans

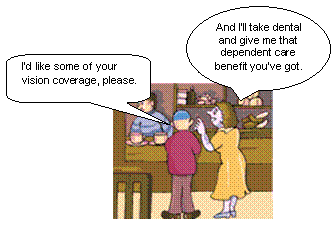

Cafeteria plans are also called Section 125 plans.

Cafeteria plans are also called Section 125 plans.

To understand these plans, think of a food cafeteria. You have a $10 gift certificate to spend on your lunch. You pick and choose what you want to put on your plate. If you choose more dishes than the gift certificate will pay for, you must pay the rest out of your own pocket. In other words, the employer allocates a certain amount toward the employee's health care. The employee then picks what benefits he wants. If the cost of the benefits he has chosen are more than the employer has allowed, the employee must make up the difference. These plans can provide a variety of benefits in combination with one another.

- Health/medical coverage

- Dental benefits

- Accidental death and dismemberment benefits

- Cancer policies

- Disability benefits

- Qualified life insurance and dependent care

Employee benefits are paid for on a pretax basis, which amounts to valuable savings for both employers and employees alike (no FICA matching on pretax deductions).