19.2.1 Unauthorized Entities

Unauthorized entities are those insurers who are nonadmitted, meaning they have not been approved or authorized to sell insurance in the state. Unfortunately, many times, producers really don't know if the insurer he is representing is authorized by the state or not. Nevertheless by law, the producer can be held liable just as the unauthorized entity can. The state's guaranty fund only covers claims against authorized insurers. Everyone loses when a claim isn't honored by an unauthorized insurer.

Health insurance scams are nothing new to the industry, but the problem is growing and spreading significantly. Unauthorized entities seem to concentrate on the health insurance market most but they have spread to different areas as well.

Many consumers don't even realize that there are such things as unauthorized entities out there in the marketplace selling insurance products to the unsuspecting. These counterfeit companies prey upon consumers with promises of high quality coverage and low premiums. Many people may feel this is "too good to be true" - and most likely, it is!

Any person who in any manner assists directly or indirectly in the procurement of any unauthorized insurance contract is prosecutable under Florida law.

The rising costs of insurance premiums have made insurance more and more difficult for the average citizen to afford. This predicament has led many to seek "alternative" insurance, purchasing policies with lesser-known companies who are offering lower premium rates and then merely trusting and hoping that the funds will be available for them when they need it. The promise of lower premium payments and discount health plans are a lure. Many illegal or unauthorized health benefit plans use unfair rating practices as well. For instance, a generally healthy person can get a low premium rate for a health benefit plan. But let that "insured" individual get sick or become seriously ill, and their premiums will shoot up sky high. This practice is often referred to as predatory rating; the "insurer" is the predator and the consumer is the prey. Usually, the victim cannot afford the hiked-up rate and therefore is forced to surrender the policy they thought was such a good deal.

At this point, they are now saddled with a preexisting condition and may be unable to get legitimate private individual insurance protection elsewhere and are therefore forced into the ranks of the uninsured.

The burden of protection against such fraudulent schemes does not entirely rest on the state insurance departments and consumers; it is also the responsibility of insurance producers to be aware of their products and what is backing them before they market any product. There are many signals that agents should look out for--certain signals that should raise a red flag in front of their eyes.

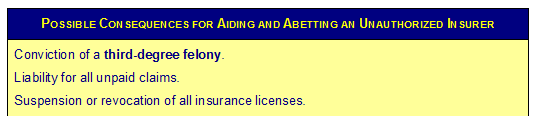

An agent who actively participates in these scams, either wittingly or unwittingly, will be held liable to the insured for the full amount of any denied claim or loss under the terms of the contract if the unauthorized insurer fails to pay the claim. Other actions that may be taken against entities and individuals transacting unauthorized insurance include examination of their records, issuing cease and desist orders, applying injunctions, requiring supervision and receivership, and any other action pursuant to state law.

Using the status or title as a licensed insurance agent in any way in connection with the placement of business with an unauthorized entity includes, but is not limited to:

- using an agent's letterhead;

- using an agent's office;

- using customer lists or contracts developed as an agent; and

- representing in any manner that the person placing this business is a licensed insurance agent.

Please read "What should insurance agents know about unauthorized insurance entities?" (Page 399 of the Florida study manual)

Many entities lead consumers to believe that the products they are offering are "ERISA plans," "ERISA exempt," "union plans," "association plans," or some variation of these. They boast low rates and minimal or no underwriting. Unfortunately, this is an all too common tactic. Qualified plans under ERISA cannot sell health insurance to the general public.

Essentially, the only health benefit plan that pre-empts the Florida Insurance Code is the truly single-employer ERISA qualified plan that is 100% self-insured; only the employees and their dependents receive the benefits of such health benefit plans.

Agents should check with the Department of Financial Services to determine if the insurer they are representing is a properly authorized insurer.