2.3 Agents and Brokers

By law, both agents and brokers are considered insurance producers. Unlike agents however, brokers represent insureds; agents represent insurers. Florida does not issue separate licenses for brokers.

The acts of the agent are considered the acts of the company.

Brokers have no authority to bind insurers to accept contracts. The products they sell are always subject to the insurer's approval.

An Agent can bind a contract - a Broker cannot.

There are three entities involved in the concept of agency.

- The agent

- The insured

- The insurance company

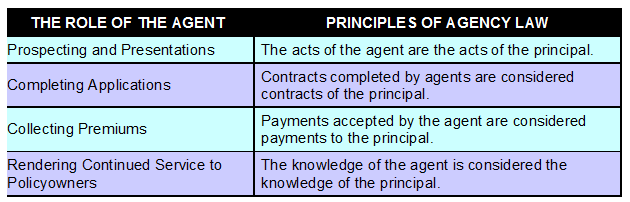

The agent is the intermediary between the other two parties and is responsible for soliciting applications, giving presentations, collecting premiums, selling policies, and providing ongoing assistance to future prospects and established clients alike. The authority of an agent to undertake these functions is clearly defined in a "contract of agency" (or agency agreement) between the agent and the company. The agent acts on behalf of and retains the power of the principal (insurer) with regard to contractual arrangements with third parties. For all intents and purposes, the agent IS the principal in the eyes of the law.

Agency Law refers to the relationship between the agent and the company with whom the agent is affiliated.