13.2.1 Hospital Expenses

While some policies reimburse insureds for the daily room and board charge (up to a specified dollar amount), other policies provide a service type of benefit which pays an amount equal to the hospital's daily charge for a semiprivate room. Not only are the daily room and board charges taken care of, basic hospital expense policies cover hospital "extras" or miscellaneous charges as well (again, up to a specified limit).

While some policies reimburse insureds for the daily room and board charge (up to a specified dollar amount), other policies provide a service type of benefit which pays an amount equal to the hospital's daily charge for a semiprivate room. Not only are the daily room and board charges taken care of, basic hospital expense policies cover hospital "extras" or miscellaneous charges as well (again, up to a specified limit).

Medical Reimbursement Plan/Medical Indemnity Plan

The Medical Reimbursement Plan and the Medical Indemnity Plan are two different approaches in regard to medical expense plans.

In a medical reimbursement plan, the policyowner is the beneficiary and expenses are reimbursed for the actual loss incurred.

Indemnity plans, on the other hand, pay a fixed amount per day of hospitalization. If the policy states a daily benefit of $200 and the hospital charges only $100 per day, the policy will still pay the $200 per day benefit and the insured can use the extra $100 at his/her discretion.

"Accident-Prone Joe"

Joe is known for being accident prone and this time his accident lands him in the hospital for 5 days. If Joe owned a reimbursement insurance policy for $15,000 and had medical bills that amounted to $3,000, his insurance company would pay $3,000 for the medical expenses. However, if Joe owned indemnity insurance coverage of $200 for 5 days, the policy would not pay the medical bills; it would give him a lump sum for Joe to spend appropriately. Joe would receive $200 x 5 = $1,000 to assist in medical expenses.

Joe is known for being accident prone and this time his accident lands him in the hospital for 5 days. If Joe owned a reimbursement insurance policy for $15,000 and had medical bills that amounted to $3,000, his insurance company would pay $3,000 for the medical expenses. However, if Joe owned indemnity insurance coverage of $200 for 5 days, the policy would not pay the medical bills; it would give him a lump sum for Joe to spend appropriately. Joe would receive $200 x 5 = $1,000 to assist in medical expenses.

Daily Room and Board

Hospital expense policies cover room and board expenses to varying degrees and various lengths of stay. Some policies put caps on benefits and some will only pay the going rate for the hospital's semi-private room (whether the patient is in a private room or not).

Miscellaneous Expenses

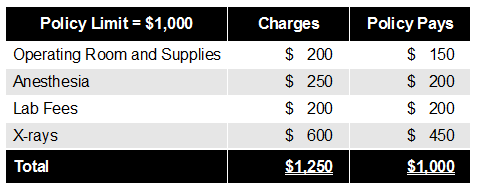

Covered miscellaneous expenses include drugs, x-rays, anesthesia, lab fees, dressings, and the use of the operating room and supplies.

Miscellaneous expense coverage does NOT cover physician services, even in case of an emergency.

Generally, maximum miscellaneous expense benefits are expressed as a multiple of the daily room and board benefit or may be a stated dollar amount. Some policies may even specify individual maximums for certain expenses within the maximum miscellaneous benefit.

Say Jim's policy provides $1,000 maximum miscellaneous expense coverage with a $150 limit on operating room and supplies, $200 limit on anesthesia, $200 on lab fees, and $500 on x-rays. The operating room and supplies cost $200, anesthesia cost $250, lab fees cost $200, and x-rays cost $600. The following table will show you how this computes.